Initiatives of Enhancing Corporate Governance

Our efforts to strengthen governance in the previous fiscal year

-

01. Basic Concept

The Kurita Group aims to contribute broadly to society through corporate activities in the fields of water and the environment in accordance with the Kurita corporate philosophy, "Study the properties of water, master them, and we will create an environment in which nature and humanity are in harmony." The Kurita Group will work to promote sustainable growth and enhance its corporate value in the medium and long term, deferring to the rights and positions of various stakeholders such as customers, business partners, employees, shareholders, and local communities while striving to meet their expectations. To this end, the Kurita Group is working to establish corporate governance, with the aim of realizing transparent, fair, prompt, and decisive decision-making and highly effective management supervision.

-

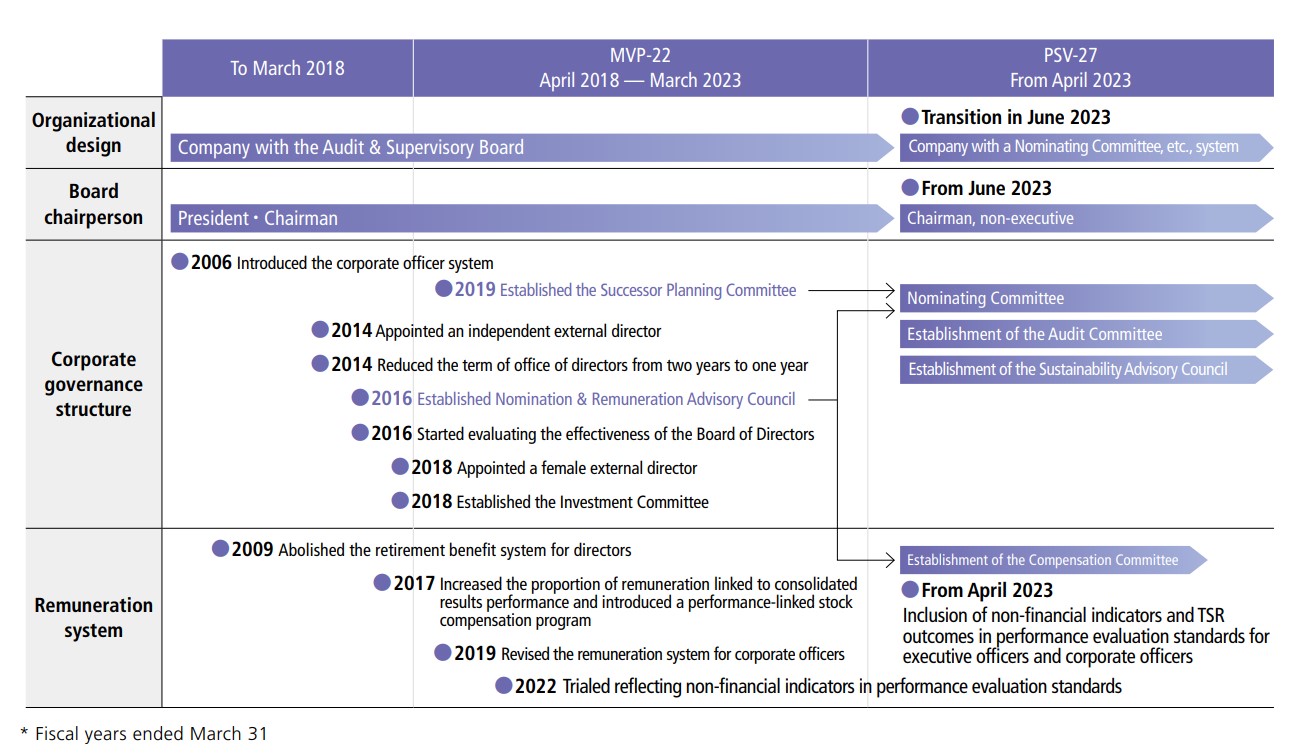

02. Timeline of Corporate Governance Improvements

The Kurita Group has sought to develop its governance structure to ensure that it fulfils its social obligations as a global enterprise while continuing to grow. Going forward, to ensure the Board of Directors can maintain the highest level of functionality, the Group will seek to build an optimized corporate governance set-up by reinforcing governance through appropriate review and adjustment.

-

03. Nomination of directors and selection of successor candidates

A. Policies and procedures for nominating directors

The process of selecting candidates for external and other directors is designed to give due consideration to diversity while creating a system of management oversight that enhances corporate value and reflects the perspectives of shareholders and other stakeholders. Nomination of candidates for director is based on predetermined requirements. The Nominating Committee selects candidates for recommendation to the General Meeting of Shareholders, including a clear rationale for each.

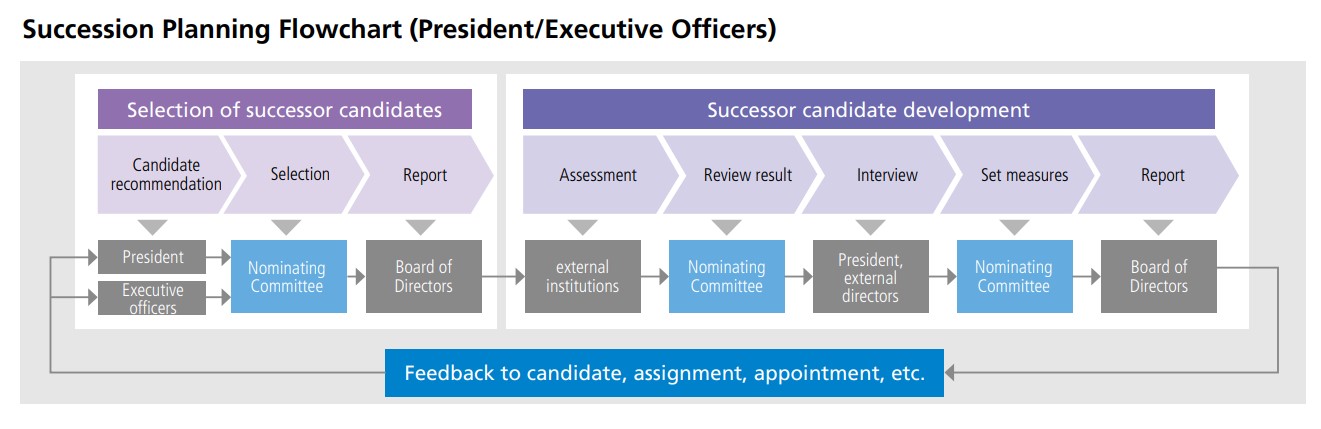

B. Succession planning process

The Nominating Committee will deliberate on requirements for the President and Executive Officer in light of the aims of the Company and specific management strategies and then report the results to the Board of Directors. The Nominating Committee will select multiple candidates for the successor to the President and Executive Officer and develop succession planning measures based on requirements set forth by the Board of Directors. The Board of Directors will regularly confirm the selection of candidates for the successor to the President and Executive Officer, development of the succession planning measures, and its progress based on reports from the Nominating Committee. The successor candidates are selected and trained through an objective and transparent process complemented by inputs from an external body concerning assessment of each candidate.

C. Policies and Procedures for Nominating and Appointing/ Dismissing the President and Executive Officer and Other Executive Officers

In appointing the President and Executive Officer and other Executive Officers, the Board of Directors will review the management structure at least once a year so that the administrative structure will create shared value with stakeholders and contribute to the sustainable growth of the Kurita Group. The Board of Directors will nominate candidates for the President and Executive Officer and other Executive Officers, and decisions on the selection and dismissal of the President and Executive Officer and the appointment and removal of Executive Officers are made by the Board of Directors based on reports from the Nominating Committee. The Nominating Committee will also review the status of business execution twice a year, and deliberate on whether it I appropriate to continue with the position of President and CEO, and report the results to the Board of Directors.

-

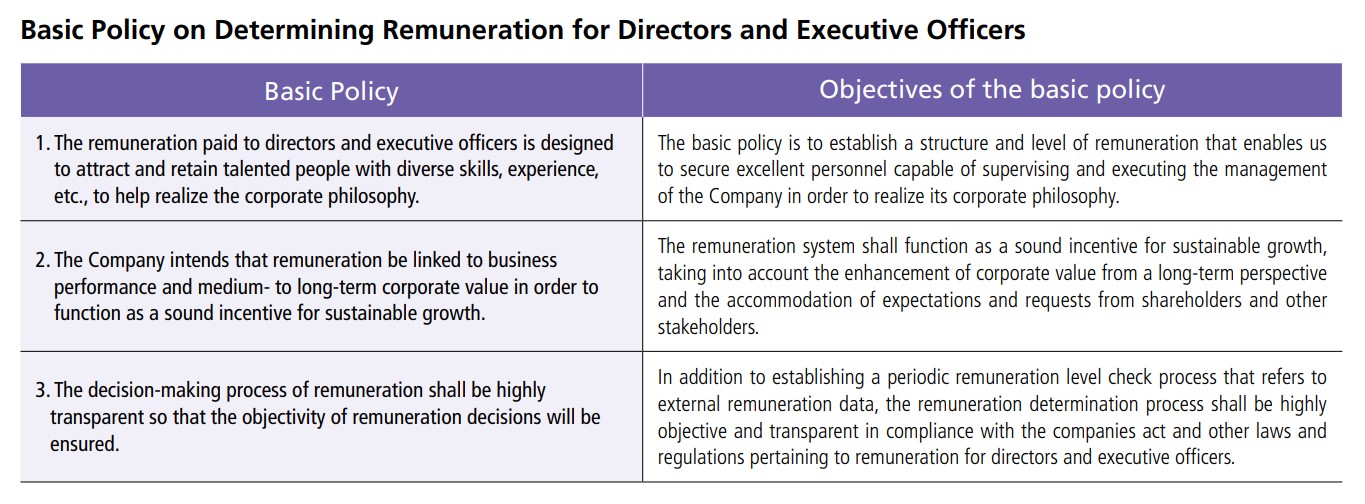

04. Determining Remuneration for Directors and Executive Officers

A. Basic Policy on Determining Remuneration for Directors and Executive Officers

B. System of executive remuneration

The policies relating to remuneration amounts and calculation methods for directors and executive of¬ficers are determined for each position in line with the Group's relevant basic remuneration policy. With the aim of increasing the objectivity and transparency of related decision-making processes, the structure and levels of remuneration for directors and executive of¬ficers as well as the performance evaluation of executive officers are determined by the Compensation Committee, with related status updates promptly reported to the Board of Directors.

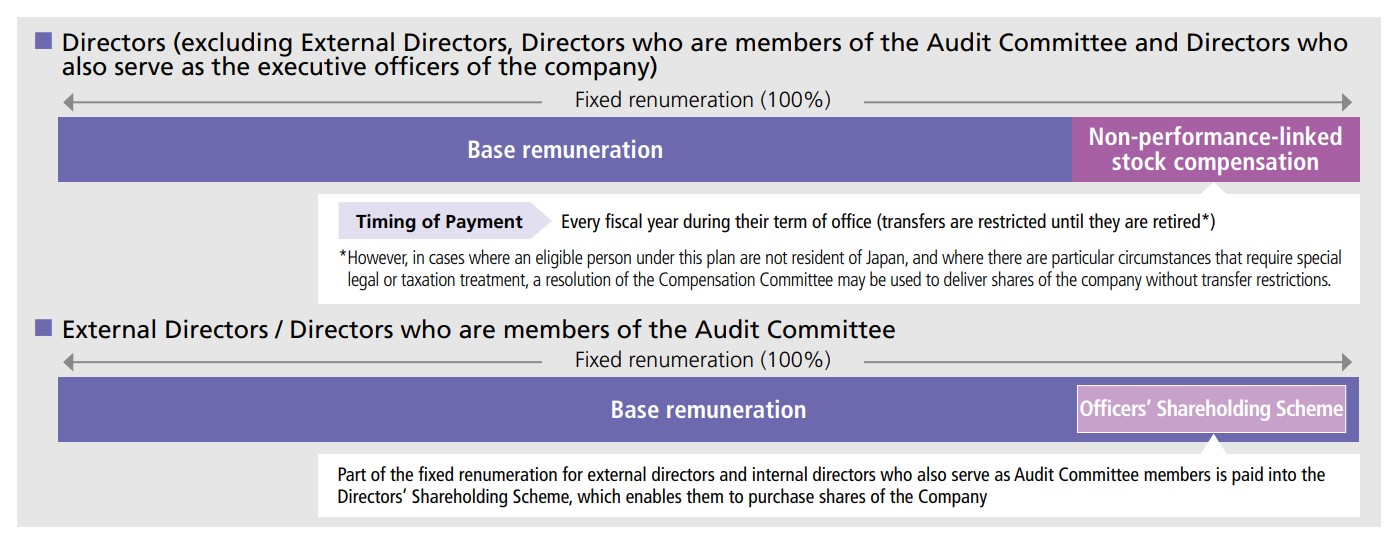

1. Director

To assist them to be focused on their core duty of management supervision, the remuneration of all the directors is limited to a fixed remuneration.

The fixed remuneration for directors excluding external directors and directors who are Audit Committee members is determined by their position, and for directors to share the risk of share price fluctuations that our shareholders are subjected to, a portion of the fixed remuneration is paid in the form of non-performance-linked stock.

In the non-performance-linked stock compensation system, points are granted in accordance with their position, and a number of shares of the companyʼs stock (with restriction on transfer) equivalent to the number of points granted are annually delivered to the director.

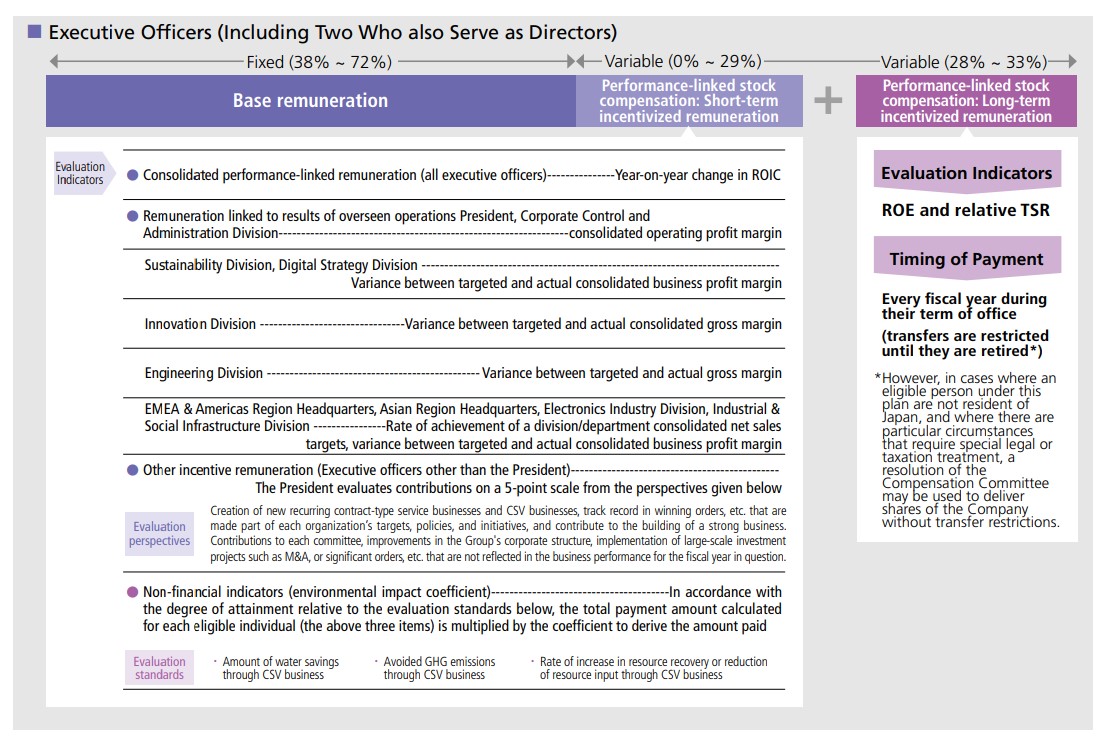

2. Executive Officer

Remuneration of executive officers is composed of a base remuneration based on job position plus a performance-linked portion split into short-term and long-term incentive components.

The performance-linked renumeration that forms short-term incentive is divided into multiple parts, where one part is linked to the overall consolidated performance of the Group, another is linked to the outcome of the business unit under the recipient officerʼs supervision, and the remaining parts are linked to other contributing factors including environmental impact coefficients. The performance indicator used for the remuneration linked to consolidated performance is year-on-year change in return on invested capital (ROIC). To determine the amount of the renumeration part linked to the outcome of the business unit under the recipient officerʼs supervision, the applied performance indicators include the difference between the planned target of the consolidated overall operating profit margin and its actual result and also the difference between the planned target of the consolidated business profit of the business unit under his or her supervision and its actual result. For the remuneration parts related to other contributing factors, we apply the implementation record of large investment projects, e.g. strengthening the corporate structure, M&A, etc., which may not be reflected in the performance for the relevant fiscal year, as the evaluation perspective. We set an environmental impact coefficient that assesses average value of degree of achievement in each indicator of water saving, avoided GHG emissions, and increase in resource recovery or reduction of resource input, through CSV business, with the aim of accelerating business operations with social value as the starting point and enhancing corporate value through the realization of social value. The amount of short-term incentivized remuneration is determined by calculating a variable payment rate from the level of achievement reflected in the performance indicators that are used for determining the remuneration parts linked to consolidated performance, the outcome of the business unit under that officerʼs supervision and other contributing factors. This calculated payment rate is then multiplied by a couple of coefficients, one of which corresponds to the level of achievement reflected in the environmental impact coefficient and another corresponds to the base amount for the officerʼs position relating to short-term incentive remuneration, to finally determine the short-term incentive renumeration amount.

The amount of long-term incentivized remuneration uses consolidated return on equity attributable to owners of parent (ROE), and total shareholder return (TSR) as the performance indicators, and is calculated by multiplying a variable payment rate, that reflects the level of achievement of consolidated ROE, by a couple of coeffcients, one of which corresponds to the level of achievement of TSR and another that corresponds to the base amount for that officerʼs position relating to long-term incentive remuneration, to finally determine the long-term incentivized renumeration amount. The reason for selecting ROIC, consolidated operating profit margin, consolidated ROE, TSR, etc. as the performance indicators for performance-linked remuneration is because these are management indicators that directly reflect the results of business performance and are also metrics of high interest in the eyes of our shareholders. This performance-linked remuneration is determined at the Compensation Committee, with related status updates promptly reported to the Board of Directors.

-

05. Auditing set-up

The Audit Committee comprises a total of three members, including two External Directors and one non-executive Director who is familiar with our businesses. Of the three members, at least one must have sufficient expertise in finance and accounting. Of the current three Committee members, two actually have such finance and accounting expertise.

The Kurita Groupʼs Audit Committee is required to have full-time members. In the current Committee membership, two are selected to serve as full-time members and one of them is the Committee chairperson.

The Audit Committee is responsible for auditing the execution of duties by Directors and Executive Officers, preparing audit reports, and approving proposals to be submitted to the General Meeting of Shareholders regarding the election and dismissal of Accounting Auditor. The Company provides a dedicated the Secretariat to the Audit Committee, staffed by our full-time employees, to assist the Committee members to perform their duties. If required, the Audit Committee may also request additional assistance from members of the Internal Auditing Department, which is in charge of internal audits of the company. To ensure the accuracy of operations at our group, the members of the Audit Committee selected by the Audit Committee have been conducting audits and surveys with respect to the Company and the Group Companies in accordance with audit policies and audit plans, etc. established by the Audit Committee. -

06. Audit Record by the Audit Committee during the Fiscal Year ended March 31, 2024

In the fiscal year ended March 31, 2024, the Audit Committee discussed specifi¬c matters such as the formulation of audit policies and plans, preparation of audit reports, the reappointment of the Accounting Auditor, remuneration for the Accounting Auditor, and other agenda items for submission to the Ordinary General Meeting of Shareholders, including activities as the executive audit meeting body to prepare for our transition to an organization with a nominating committee. The Committee, by collaborating with the Internal Auditing Department and the Accounting Auditor, audited the status of establishment and operation of the internal control systems (including internal control over ¬financial reporting) and Group governance systems, and the status of priority measures in the business plan, all of which have been defined as priority audit items in the audit plan. For the fiscal year ended March 31, 2024, the Audit Committee held 14 meetings including two Audit & Supervisory Board, and 100% of the Committee members and Directors attended all of the 14 meetings.

-

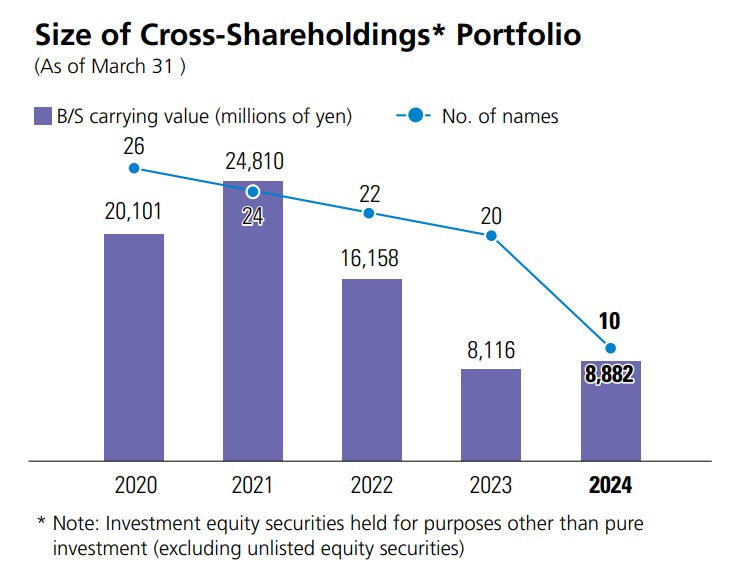

07. Shareholdings of Other Listed Companies

The Company holds shares of other listed companies to strengthen business relationships. We verify the economic rationale for mutual shareholdings and examine relationships with companies whose shares the Company holds based on our transaction history. The Board of Directors conducts periodic reviews of the appropriateness of Kurita's cross-shareholdings and is looking to cut the number of such shares held. As of March 31, 2024, the number of shares other than unlisted stocks reduced by 10 names.

A. Cross-shareholdings policy

- In some cases, the Company holds shares of other listed companies to strengthen business relationships, etc.

- When holding such shares, the Company makes efforts to minimize the risk of holding the shares. The rationale for holding each stock is reviewed on a regular or timely basis by the Board of Directors. Based on the results of the examination, the Company works to reduce the holding of shares of other listed companies.

- The Company exercises voting rights for each proposal based on whether it will contribute to an increase in shareholder value.

- If a shareholder indicates its intention to sell the Company's shares, the Company will not prevent the shareholder from making such sale, etc.