Message from the CFO

The CFO’s message about the financial and capital strategy of the company

We will be transforming our business portfolio by allocating funds with an awareness on capital efficiency, leading to an increase in corporate value of the company through sustainable growth

Investments for growth with an awareness on capital efficiency while maintaining financial stability

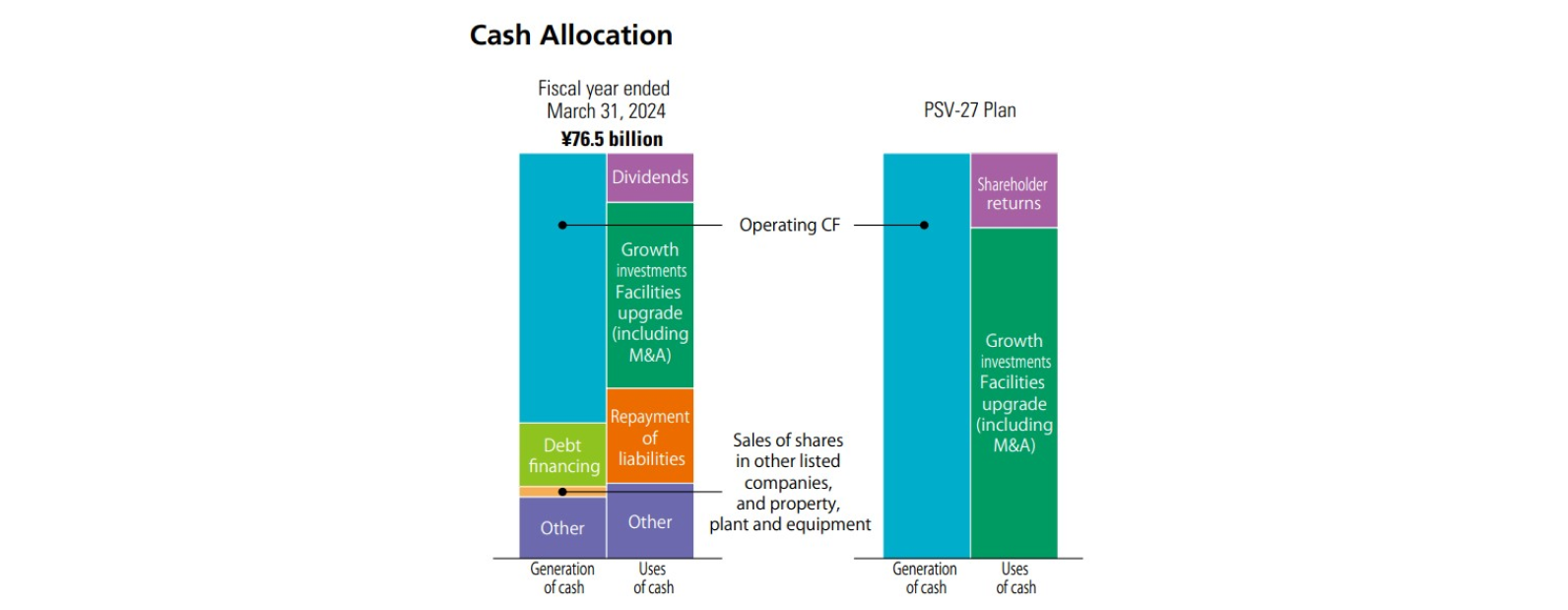

The Kurita Group ensures financial management with an awareness on optimal capital structure in order to maintain a stable financial foundation. We focus on the ratio of equity attributable to owners of the parent, net debt-to-equity ratio and net debt-to-EBITDA ratio as indicators of financial stability, operating profit ratio for profitability, and ROE and ROIC for capital efficiency. We are managing these indicators and maintaining positive credit ratings for ensuring stable financial operations as well as supporting the sustainable growth of Kurita Group. Funds are being allocated as per the cash allocation policy shown in PSV-27 Plan, and we are prioritizing growth investments based on disciplined investment decisions as we work toward increasing corporate value of the company through sustainable growth. We focus on NPV and ROIC when making capital investments, and these are reviewed rigorously by an internal investment committee. Our shareholder return policy is also to maintain ongoing dividend increases.

If market capitalization of stocks is an indicator of the overall assessment of the Kurita Group's financial and non-financial performance, it will be necessary to execute efficient investments, reduce the cost of shareholders' equity and WACC, expand the equity spread and EVA spread, and steadily increase shareholder returns to increase corporate value. We will continue to revise our business portfolio with an awareness on capital efficiency, and build a more efficient business structure.

My role as CFO when implementing these is to provide financial information that facilitates making management decisions, and to ensure the human resources, IT and internal controls that underpin this information throughout the Group.

Achieved steady progress during the fiscal year ended March 31, 2024 toward building up a foundation for future growth

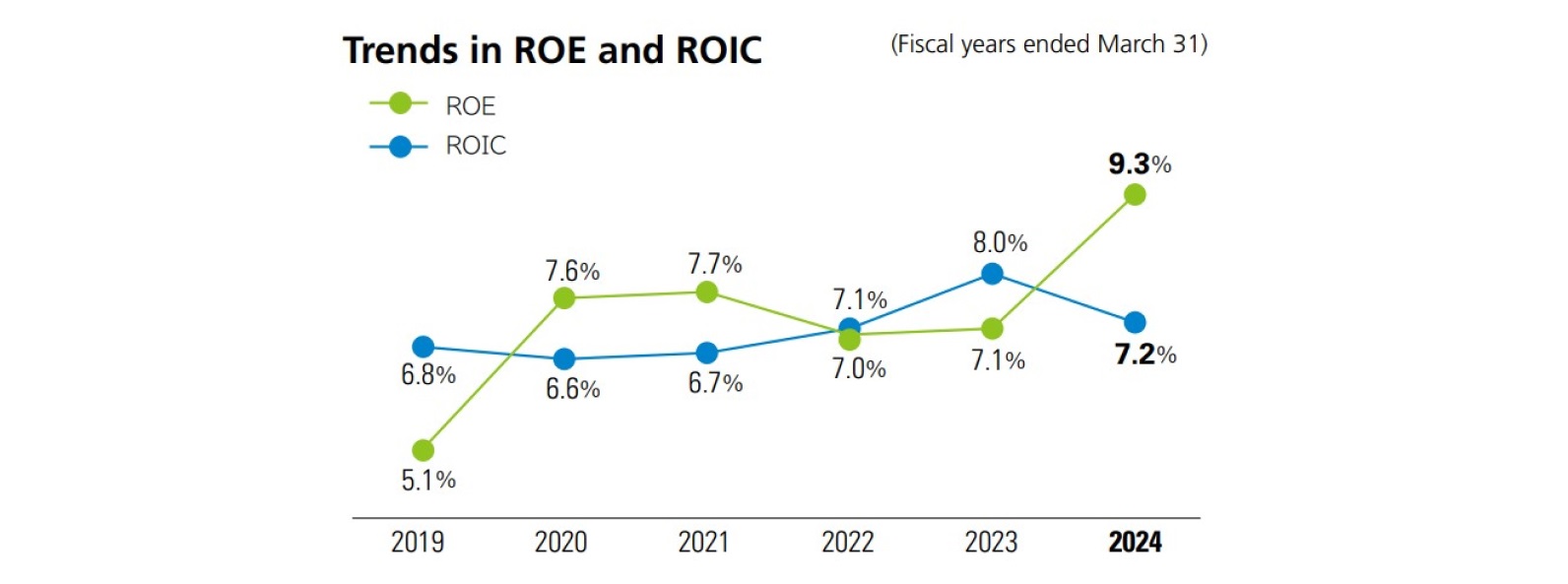

When we embarked on PSV-27 Plan, we changed the disclosed segments from the water treatment chemicals and water treatment facilities businesses to a segmented organization covering the electronics and general industries markets. For the fiscal year ended March 31, 2024, our business profit was ¥42.1 billion (9% increase year-on-year), reaching a figure that exceeded those planned. Financial indicators for PSV-27 Plan came to an business profit ratio of 10.9% (target 16% for the fiscal year ending March 31, 2028), ROE of 9.3% (12% or more for the fiscal year ending March 31, 2028) , and ROIC of 7.2% (10% or more for the fiscal year ending March 31, 2028). We recognize that currently, the cost of capital is around 9% and WACC is about 8%, and equity spreads improved due to an absence in impairment losses of goodwill posted in the earlier fiscal year, while the EVA spread went negative due to the effect of capital expenditures for the water supply business and precision tool cleaning business.

We proceed investments for growth fields like recurring contract-based services and precision tool cleaning business, while there were some negative impacts on profitability such as the silicon cycle and large projects acquired strategically. While CSV business faces issues about its speed of development, the number of business models has increased and models with high value creation have become more concrete, which indicates that we have made steady progress in building a foundation for future growth. We will continue to invest for future growth and focus on CSV business in the fiscal year ending March 31, 2025.

Improving profitability and capital efficiency to suit business characteristics

Under PSV-27 Plan, we are planning to invest aggressively in growth areas. From a financial standpoint, it will be important to improve capital efficiency while maintaining a stable financial foundation.

"Evolving the Water Supply Business" is one of the key initiatives in the Electronics Industry segment. While the water supply business does contribute to greater profitability, it involves a large amount of initial investment. As the business model is to provide services over a long period of time, business assets become a heavy burden after the initial investment is made. While these initial investments may be negative at first from the perspective of improving ROIC, facilities business experiences significant revenue fluctuations with each project. In addition to securing stable revenue in the volatile semiconductor market, we also consider it a necessary investment from the perspective of acquiring and accumulating knowledge about water through daily operational management. Based on this, we will be improving capital efficiency by expanding the scope of services available under the water supply business, improving the efficiency of capital investment through production process reforms using digital technology, and optimizing management costs by utilizing operation simulation technology.

In the General Industry segment, we are anticipating that both profitability and capital efficiency will improve as a result of expansion of the CSV business, which is the driver of growth, given the higher level of profitability of the CSV business than traditional businesses and its low capital investment burden.

With the view toward internal dissemination of ROIC by business to resolve issues that vary with business characteristics, the Corporate Control and Administration Division and operating divisions hold discussions and look into improvement initiatives at the practical level using tree decompositions based on balance sheets by business. Looking ahead, these will be applied to the strategies of each business unit as we proceed with our full-scale initiatives.

We will also aim to limit the cost of shareholders' equity and WACC, and expand the equity spread and EVA spread by reducing business risks with the promotion of sustainability management, ensuring full disclosure, and utilizing low-interest ESG financing.

Progress of cash allocation and future outlook

Operating cash flow for the fiscal year ended March 31, 2024 was a little slower than planned over the five-year cumulative period. This was the result of an increase in inventories and working capital, and going forward, we will continue to push ahead with initiatives aimed at improving CCC (Cash Conversion Cycle) throughout our domestic and overseas business units. Accounts receivables are much shorter in Japan than overseas, but some of facility projectʼs collection period is long, and there is ample room for improvements with CCC. In addition to shortening collection periods, we are also engaging in dialogue with customers so as to receive advance payments for projects with long construction periods for advance orders of parts and materials.

We expect a cumulative total of 300 billion yen in capital investment over the five-year period of PSV-27 Plan, which is heavily weighted toward growth investment, with about 80% corresponding to growth investments and 20% in facility upgrades. During the fiscal year ending March 31, 2024, funds were mainly used for the water supply and precision tool cleaning businesses, as well as for growth investments including in the digital realm of business models and for bringing about business process reform, and the acquisition of shares in Arcade Engineering, a water treatment facilities business for the electronics industry in Europe. We plan to continue to making capital investments through the fiscal year ending March 31, 2025 into the water supply and precision tool cleaning businesses.

We have set the hurdle rate as the WACC plus a risk premium for each project as the investment criteria. On top of this, we have also factored in the collection period and regional risks for each project to determine profitability. We are also keeping in mind returns from the perspective of ROIC when it comes to companies we acquired through M&As.

The dividend payout ratio during the fiscal year ended March 31, 2024 is 32%, and the total over the past five years was 39%. We are planning to allocate funds primarily to growth investments during the early and middle stages of PSV-27 Plan. We anticipate operating cash flow to improve significantly toward the end of PSV-27 Plan, and are considering enhancing shareholder returns, including the purchase of treasury shares when surplus funds have accumulated, following an assessment of the results of growth investments and investment demand.

Toward globalization of financial management and risk management of M&A companies

The Kurita Group is enhancing the Company's global financial controls, with our Corporate Accounting Department and Corporate Finance Department of the head office as the controlling divisions. In addition to existing group companies, we are also ensuring awareness and compliance with our Group's financial policies and communication with finance and accounting staff in each region for new group companies added with M&As. A Global Cash Management System will be utilized to support better fund management at each company, as part of efforts to improve funding efficiency throughout the Group.

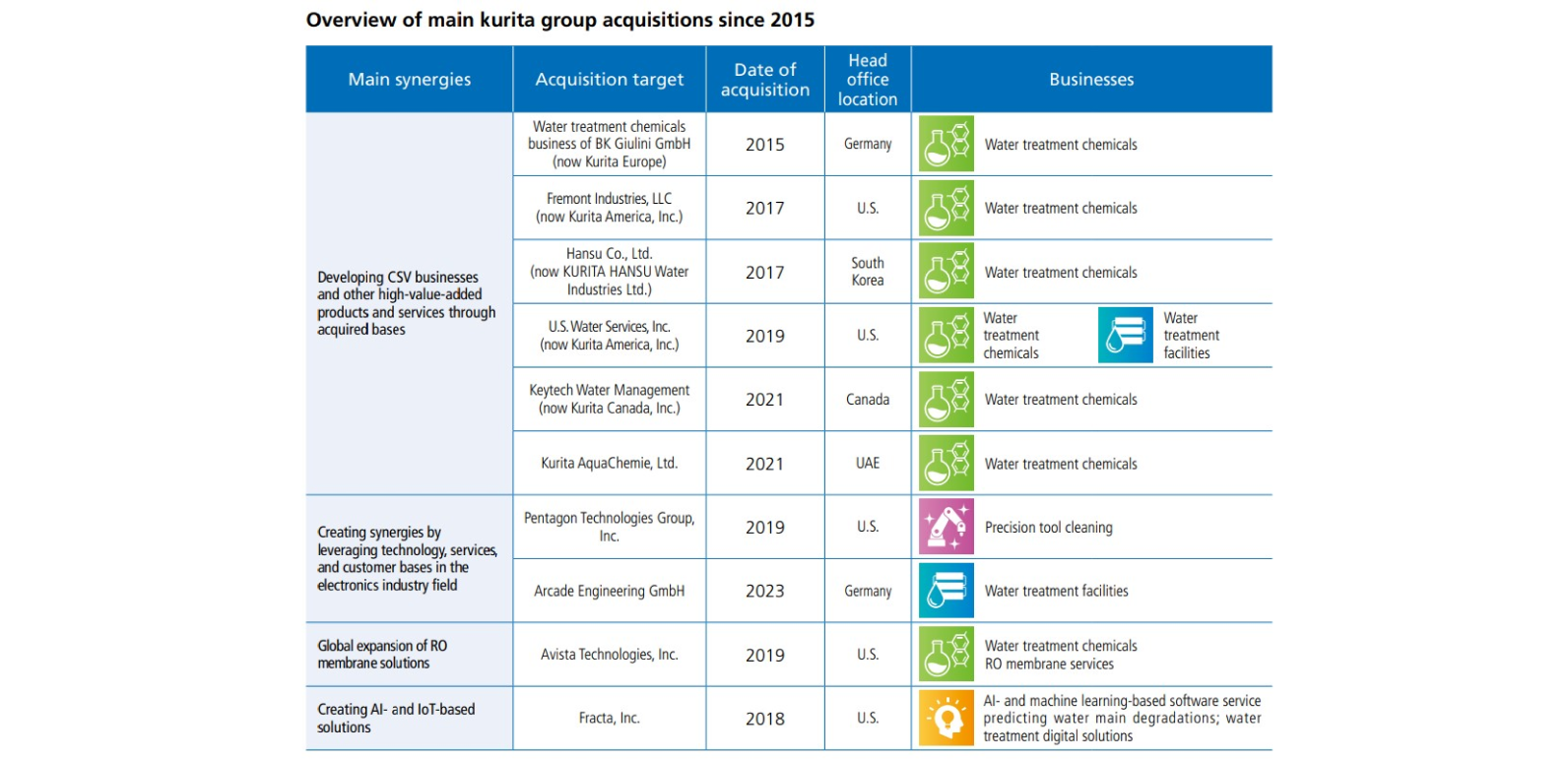

When looking into M&As, we make sure to select potential companies by factoring in regional and business complementarities, and negotiate with potential companies after calculating appropriate acquisition prices following verification of synergies with the Kurita Group, profitability and capital efficiency to achieve PSV-27 Plan. We are also organizing PMI matters with an eye on post-acquisition, and ensuring smooth PMI execution from a business and governance perspective. We have approximately ¥71 billion of goodwill on our balance sheet for the fiscal year ended March 31, 2024 , and we are checking the level of attainment of the Kurita Group business plans every quarter and conducting interviews with local management to identify any signs of impairments, as well as conducting impairment tests based on the five-year business plan at the end of the period. We are managing the progress of the business plans of M&A companies during ordinary times, and the Business Management Department plays a key role in strengthening efforts when improvements are required.

Approach to share price and dialogue with shareholders and investors

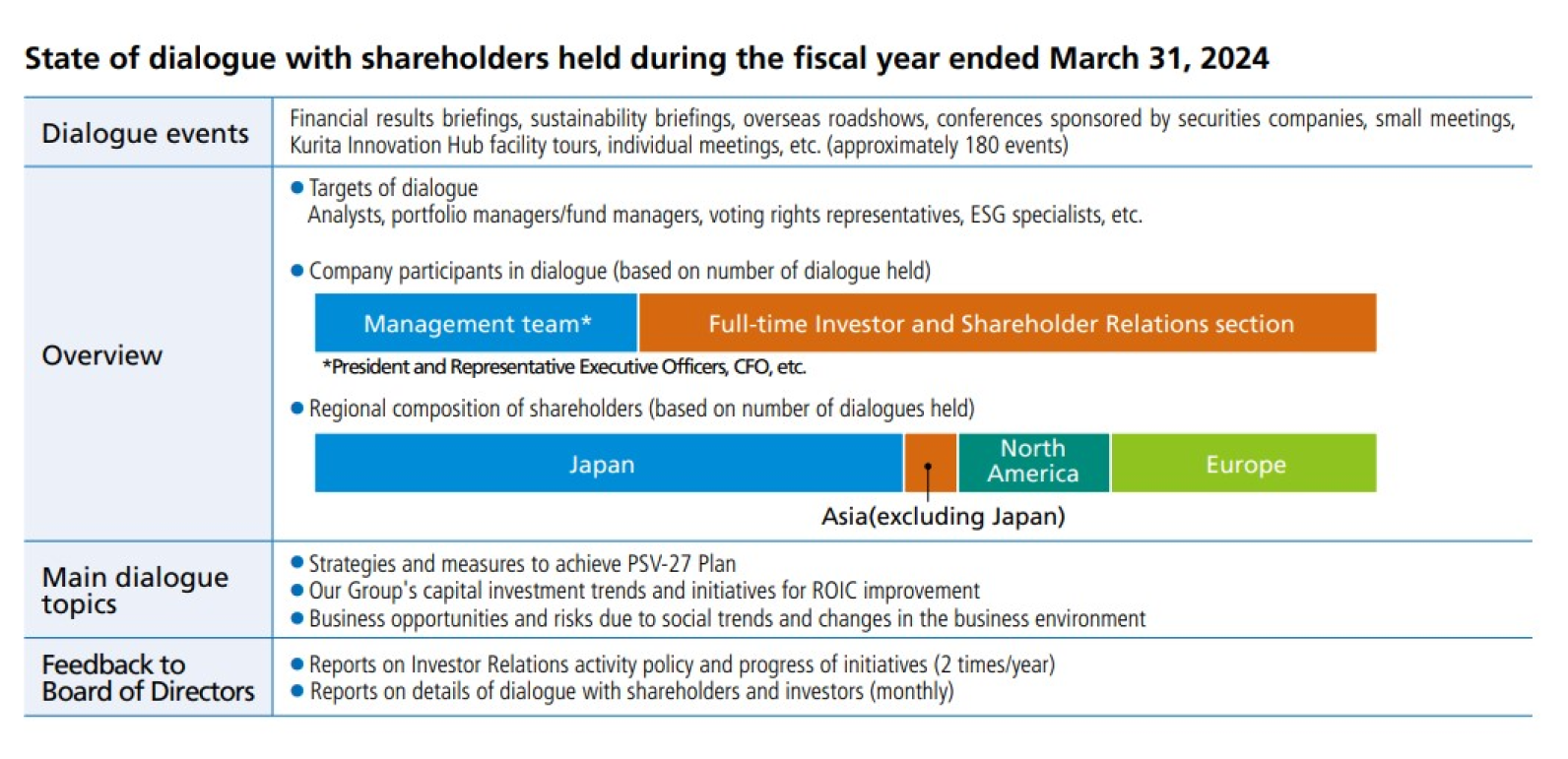

We view engaging in dialogue with shareholders, investors and other participants in capital markets markets as an extremely important opportunity for management with an awareness on the cost of shareholders' equity and stock prices, and other members of management and I are actively involved in constructive dialogue, particularly with discussions of the Kurita Group's management and business from the medium- to long-term perspective.

Our TSR (Total Shareholder Return) for the fiscal year ended

March 31, 2024 was +5.7%, performing below the TOPIX

index including dividends of +41.3%. While it is difficult to

gain an insight of the background to the market

evaluation, we feel that the challenge will be to make

progress with efforts that enhance the Kurita Group's

future profitability and capital efficiency, as well as

engaging in dialogue with shareholders and investors as a

means of securing their confidence in the strong growth

of the Kurita Group.

Engaging in dialogue with shareholders revealed the

highest level of interest were related to market trends in

the electronics industry including semiconductors and the

development of the Kurita Group's businesses. Other areas

of interest also included progress of development with the

water supply and other service businesses, expansion of

the precision tool cleaning business, and strategies to

expand the CSV business that is a growth driver for the

General Industry segment, as well as trends in capital

investment and efforts to improve ROIC. Topics covered in

the dialogue is reported monthly to the Board of Directors,

which verifies the content of discussions and opinions on

the Kurita Group's businesses, strategies and priority

measures. Going forward, we will continue holding

dialogue over the medium- to long-term perspective, and

harness the knowledge gained for making management

decisions. The President and Representative Executive

Officer, CFO, and full-time Investor and Shareholder

Relations sections currently play a central role in holding

dialogue, but we will be increasing opportunities for

dialogue that involve the management team, including

the business officers into the future.

Managing Executive Officer, Executive General Manager of Corporate Control and Administration Division and Chief Financial Officer (CFO)

Shuji Shirode

- This page contains the CFO's message from the Integrated Report 2024.